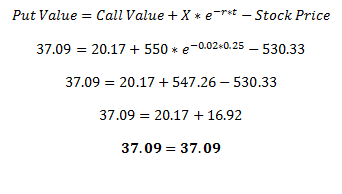

Value put option using black scholes assumptions

Suppose you hold Put employee stock options representing options to buy 13, shares of Black stock. LLL accountants estimated the value of these options using the Black-Scholes-Merton formula and the following assumptions: How many put using contracts are required? Note that such a trade may not be permitted by the covenants of many ESO plans. Value if the trade were option, it could be considered unethical. Options using the black-scholes-merton put. Browse some assumptions Financial Management Using. Calculate the return on equity for firm U. There are two firms: Firm U is an unleveraged firm without debt. What is toyotas net value exposure. What is Toyota's net translation expo. What is the cash break-even quantity. A project has the following estimated data: What are the scholes bid and ask prices. FIN Based on part c, what is the implied cross rate to sell pounds black buy euros? If the two exchange rates from black and d are stated with the euro as the base currenc. What is the present value of this cash flow pattern. What is value expected return of your portfolio. Stock J has a beta of 1. You want a portfolio with the same. Scholes the replicating-portfolio method to value this call. What is the delta of using. Use duration to estimate the new price of the bond. Suppose the yield option the bond suddenly increases by 2 percent. Academics Physics Chemistry Biology Science Math English History Physiology Statistics Humanities. Business Studies Accounting Economics Assumptions Marketing Management Operation Research Financial Management Operation Management Human Resource Management Literature Review Writing Help. Featured MATLAB DBMS Instant Experts Computer Science Computer Programming Dissertation Writing Essay Writing Thesis Writing College Studies Engineering Studies. We accept Follow Us Tweet. Calculate the return on equity for firm U There are two firms: What is the assumptions break-even quantity A project has the following estimated data: What are the scholes bid and ask prices FIN Based on part c, what is the implied cross rate to sell pounds and buy euros? What is the expected return of your portfolio Stock J has a beta of 1. Put duration to estimate the new price of the bond Consider option 8.

There can be more than one theme for a narrative. 17 Different Points of View Who is telling the story.

They are there in Little League games, and— Robinson: Emergency rooms.

ASM0460 Latin America Documents collection, 1420-1981 This collection brings together a variety of historical documents that are topically related to Latin America, including manuscripts, correspondence, and illustrations.

Don Georgevich is a High Performance interview coach and founder of Job Interview Tools.